Lower Your Tax Bill When You Invest in Equipment

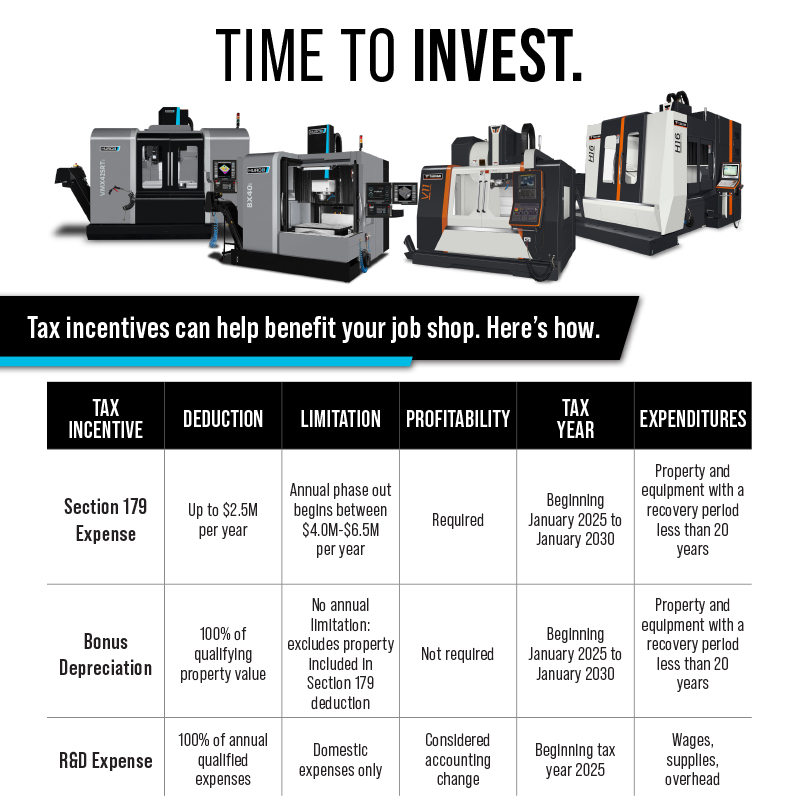

Businesses investing in qualifying equipment in 2025 may benefit from powerful tax incentives under Section 179 and Bonus Depreciation. These programs allow you to deduct a large portion—or even the full cost—of eligible equipment purchases, lowering your taxable income and improving cash flow.

Section 179 allows businesses to deduct the full purchase price of qualifying equipment financed or purchased during the tax year, up to a certain limit. It’s designed to encourage small and mid-sized businesses to invest in themselves.

*Up to $1,220,000 deduction limit for 2025. Applies to new and used equipment. Equipment must be placed in service by December 31, 2025.

Bonus Depreciation

After reaching the Section 179 limit, Bonus Depreciation allows you to depreciate a percentage of remaining equipment costs in the first year.

*60% bonus depreciation available for 2025. Applies to both new and used equipment. Can be combined with Section 179 for maximum tax savings. Figures subject to IRS updates. Consult your tax advisor for your specific eligibility.

How It Works (example scenario):

- Purchase $300,000 worth of qualifying equipment this year.

- Section 179 Deduction: $300,000

- Tax Savings (assuming 30% tax rate): $90,000

This effectively lowers your cost of ownership — and improves ROI from day one.

Want a Custom Estimate?

We offer a tax savings calculator to help you estimate your potential deductions and savings. Our team can walk you through how Section 179 and Bonus Depreciation might apply to your unique purchase plans.

Click Here to Request Your Estimate!

*These tools are for demonstration purposes only and do not replace the advice of a qualified tax professional. Your actual deductions may vary based on your business’s financial circumstances.

Contact our team today to schedule a walkthrough of the calculator or get a custom quote with potential tax savings included.

Phone: (781) 871-3400

Sales: sales@brooksmachinery.com

Service: service@brooksmachinery.com